Content

But if you have the tolerance, risk capital, and willingness to learn to swing trade, you might find it a valuable skill that could potentially supplement your longer-term investments. Swing trading can be a means to supplement or enhance a longer-term investment strategy. Swing trading is one of the few ways traders attempt to capture frequent short-term price movements in a market landscape that tends to evolve at a much slower pace. Some professionals believe fundamental analysis, with its focus on economic cycles, company and sector earnings, and other longer-term trends, isn’t typically suited for specific entry and exit points.

Swing trading can produce higher returns than the averages, but you must have a good strategy and be alert for changes. Arista Networks, Inc. develops, markets and sells cloud networking solutions in the Americas, Europe, the Middle East, Africa and the Asia-Pacific region. We independently evaluate all recommended products and services. If you click on links we provide, we may receive compensation. The material provided is for information purposes only and should not be considered as investment advice.

KEEP LEARNING AS YOU SWING TRADE INTO A BRIGHTER FUTURE

Because you have had the discipline to follow your trading system’s rules. When you allow to market to do what its meant to do, the market can give you a lot more profits than if you are a day trader or a Forex scalper. As you will note, all the Forex trading strategies on this site are not complicated. As a matter of fact, the less Forex indicators a Forex system has, the better it is for you to make money…that is in my opinion, because too much information can lead to analysis paralysis.

By recognizing and capitalizing on these changes in the market, traders can make big gains in a short amount of time. It is important to be aware of the risks of trading volatile stocks, as they can also lead to large losses. These could be news about an upcoming event, potential changes within a company, or credible rumors. Catalysts can help identify stocks with short-term potential for price movements that may not be as obvious in long-term investments. By recognizing these catalysts and acting fast, swing traders can potentially profit.

Step 6: Calculate and Manage Risk

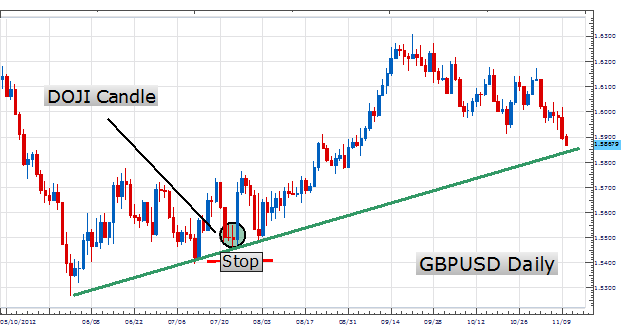

Swing traders will often look for opportunities on the daily charts and may watch one-hour or 15-minute charts to find precise entry, stop-loss, and take-profit levels. Swing trading is one of the most popular forms of active trading, where traders look for intermediate-term opportunities using various forms of technical analysis. The short answer is yes, you can swing trade with any stock or option. Stop losses can either be set just beyond the entry level, the next level, or the high/low of the entire tool, depending on the risk tolerance.

Let’s review the swing trading strategy Livermore used to help forecast the biggest stock market crash in history. It is the Wall Street crash of 1929, also known as Black Tuesday. Here is another strategy called a weekly trading strategy that will keep you sane. However, many traders employ algorithmic trading systems that always count risks and take rational decisions for more consistent profits. Human judgment can often lag behind reality, algorithms provide us with the tools to correct the errors and biases and help us make better decisions.

Nonetheless, high trading volume remains a key factor for successful swing trades. Some swing traders prefer volatile assets while others stick with more moderate stocks, which largely boils down to personal preference that is also dependent on the level of commitment and market acumen. When choosing a broker, the overnight fees are crucial for swing traders as the positions are kept open for a long time.

The Fibonacci retracement tool has long been favoured by swing traders for its ability to highlight specific areas of support/resistance where possible reversals might occur. A great starting point is guide on swing trading for beginners. You’ll learn things like how long to hold a swing trade, the swing trading pros and cons, and small account trading strategies. Today, we’ll introduce you to the highest probability swing trading strategies you can leverage in your strategy.

Five strategies for swing trading stocks

Nothing is perfect, nothing can be thought of as sacred and there are times when you simply need to move on. You could, however, come back to these assets in the future if they suit you once more. Aside from risk/reward, the trader could also utilize other exit methods, such as waiting for the price to make a new low. This method would have resulted in a profit of $23.76 per share—or, thought of another way, a 12% profit in exchange for less than 3% risk.

You can learn more about market conditions, resistance levels, trendlines and more. You can find options online to help you get started swing trading. Mindful Trader provides stock picks and options picks, but it can also teach you the trading strategy behind them.

And those trades you take can last for one day up to several days and even weeks (and possibly longer if the trade is still working and you are not stopped out). If you have a full-time job but enjoy trading on the side, then swing trading might be more your style! It is important to remember that every trading style has its pros and cons, and it is up to you the trader, which one you will choose. We also offer educational resources like CAPEX Academy to help you understand trading and get to know the risks.

The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organisation, committee or other group or individual or company. FXOpen is a global forex and CFD broker, with a network of worldwide brokerages regulated by the FCA, CySEC and ASIC. FXOpen offers ECN, STP, Micro and Crypto trading accounts (dependent https://g-markets.net/helpful-articles/can-you-start-trading-forex-with-just-100-2/ on entity). The relative strength index (RSI) is a momentum oscillator that quantifies the speed and change of an asset’s movements. It oscillates between 0 and 100, and traditionally, a level above 70 indicates overbought conditions, while a level below 30 indicates oversold conditions. When RSI moves into these areas, the likelihood of a reversal increases.

We also may participate in co-branding and other relationships to offer e-commerce and other services and features to our Users. However, even if the third party is affiliated with us, we have no control over these linked sites, each of which has separate privacy and data collection practices independent of us. We encourage you to read the policies of these third party websites. B) Unless you opt-out, we may use your e-mail or other PII to send commercial or marketing messages without your further consent. In some of our email messages we may use a “click-through URL” linked to content on the Site.

How To Find The Best Stocks For Swing Trading

But it’s not too difficult – you’ll typically rely on a moving average for this strategy. You can go with any MA you like using most, but many traders prefer the 50-day moving average. The gap and go strategy is typically a day trading strategy where day traders trade stocks gapping up or down significantly on high relative volume. The intraday volatility is the highest if the gap is caused by major earnings or company news. On the other hand, mergers and acquisitions news most often lead to gaps but not to volatility after the open since usually the exact price per share for the M&A deal was already announced.

- On the other hand, if you’re a beginner looking for an easy-to-use platform with low fees and commissions, then you may consider using eToro or Robinhood.

- However, even having a strategic and objective approach to cutting losses does not prevent swing traders from losing all their capital.

- When looking for swing trade stocks, it’s best to look for companies that have been around for a while.

- You’ll learn about things like pivot points, scalping, and ways to decipher when an asset is going to gain or lose value.

The best book on swing trading will depend on how much you already know about the topic and what you want to learn. «Mastering the Trade» by John F. Carter is Insider’s top choice, because it covers a variety of subjects and can be helpful to swing traders of all levels. Brown breaks down the basic concepts of swing trading chapter by chapter. You’ll learn how swing trading differs from day trading and position trading, and how swing trading could help you reach your specific goals rather than the other two.

Fast Benefits of Our Simple Swing Trading Strategy.

High-probability swing trading strategies also involve taking into account stock market sentiment. There are certain market conditions that are unfavorable – and even the highest probability strategies for swing trading will fall short. While there are many swing trading strategies available out there to swing trade, some tend to work out better over the longer term. This will be different for everyone involved as your psychology comes into play. For all of the strategies should be used with a proper money management scheme. And remember, the shorter your time horizon and the more trades you make, the more you’ll rack up in transaction costs.

We’ve summarised five swing trade strategies below that you can use to identify trading opportunities and manage your trades from start to finish. Apply these swing trading techniques to the stocks you’re most interested in to look for possible trade entry points. You can also use tools such as CMC Markets’ pattern recognition scanner to help you identify stocks that are showing potential technical trading signals. For instance, profit factor of $3 is considered a favourable risk/reward, while risking $1 to only make $0.75 might be considered as not favourable risk/reward.

At its core, buying fractional shares allow swing traders to purchase a unit of a whole share, and provides an opportunity to be invested in high-priced stocks with just a few dollars. You can invest in the best stocks under 2$ if you’re interested in starting small. You will have a trade blow-up when swing trading; how you react determines how successful you can be as a swing trader in the long run.

Swing Trading and CAN SLIM

On the other hand, if you’re a beginner looking for an easy-to-use platform with low fees and commissions, then you may consider using eToro or Robinhood. Combining social trading functionalities with low costs, eToro is an excellent choice for beginner investors interested in swing trading. The platform supports an intuitive and clean design and a straightforward swing trading mechanism.