The financial instruments that are bought or sold can come in many forms including shares, derivatives, bonds, exchange traded funds (ETFs) and so on. A broker can work alone but they are usually part of a brokerage firm. Brokers exist not only in financial markets, but also real estate, commodities and even the art and antique markets. Several full-service firms also have a low-cost discount brokerage division. These firms charge cheaper commissions by using computerised trading systems and requiring their clients to undertake their research, which can be done online or via a mobile app. Beyond financial trading, important decisions have to be made concerning other services like financial planning, trust formation, wealth management, tax consultation, and retirement planning.

What is an example of a brokerage?

Examples of a full-service broker might include offerings from a company such as Morgan Stanley, Goldman Sachs, or even Bank of America Merrill Lynch. The larger brokerage firms tend to carry an inventory of shares available to their customers for sale.

Most brokerage firms today allow customers online access to their investments. It is critical to properly research a brokerage house that one might be interested in before investing. The decision of which type of brokerage house to choose largely depends on the services one needs access to. One might avoid brokers with high trading fees to maximize investment gains. Is it reliable, and does it offer the necessary tools to invest as efficiently as possible?

Yacht brokers

He has the latest smartphone and he upgrades his phone every year, so he always has the latest in technology. Eddie also prefers to do his own research, so the online brokerage firm is the best choice, as it provides Eddie all the services he is looking for at a great price. A broker is an intermediary between those who want to make trades and invest and the exchange in which those trades are processed. You need a broker because stock exchanges https://trading-market.org/ require that those who execute trades on the exchange be licensed. Another reason is a broker ensures a smooth trading experience between an investor and an exchange and, as is the case with discount brokers, usually won’t charge a commission for normal trades. A brokerage firm or brokerage company is a middleman who connects buyers and sellers to complete a transaction for stock shares, bonds, options, and other financial instruments.

- He has the latest smartphone and he upgrades his phone every year, so he always has the latest in technology.

- A real estate broker searches for buyers and sellers of real estate, e.g., warehouses, offices, retail, as well as residential properties.

- If you don’t have a lot of money to invest (or to pay in fees and commissions), you’re better off going with a less expensive discount broker.

- Discount brokerages

offer fewer services than full-service brokerages and charge lower commissions. - Brokers receive compensation from the brokerage firm based on their trading volume as well as for the sale of investment products.

- Some brokerage firms exist entirely online, and nearly all firms offer you the option of placing orders electronically rather than over the telephone.

A captive brokerage is affiliated with or employed by a mutual fund company or insurance company and can sell only their products. These brokers are employed to recommend and sell the range of products that the mutual or insurance company owns. Insurance brokers represent you (the policyholder or insurance shopper), not insurance companies.

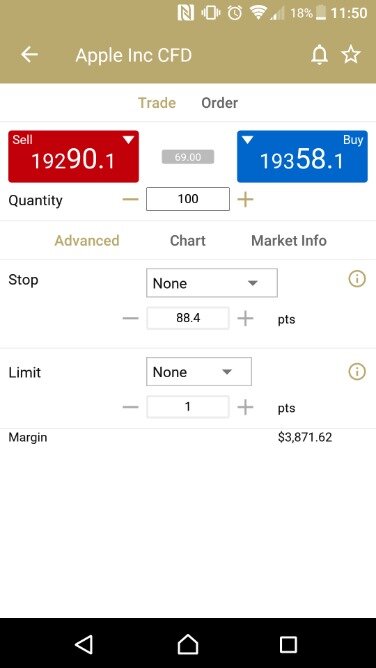

Traditional brokerages charge a fee in addition to a commission. When a trade order for a stock is performed, an investor pays a transaction fee for the brokerage company’s efforts to complete the trade. A brokerage firm operates as a go-between, bringing buyers and sellers together to complete a transaction. Brokerage firms usually are compensated by commissions or fees charged after a transaction has been completed successfully. Yet the emergence of the digital age gave rise to online brokers, many of which are execution only. These are digital investing and trading platforms that allow clients to place trades in a few clicks, and often charge less commissions, yet may not offer specialised investment advice.

brokerage

Your website access and usage is governed by the applicable Terms and Conditions & Privacy Policy. Leading robo-advisors include Betterment, Wealthfront, Vanguard Digital Advisor, Ally Invest, Acorns and Wealthsimple. The median salary for a stock broker in the United States, according to Salary.com. The broker must make a reasonable effort to obtain information on the customer’s financial status, tax status, investment objectives, and other information used in making a recommendation. In fact, virtually every citizen in the advanced economies can afford to invest in the stock market today.

Depending on your investing style, some brokerages may be better suited for you than others. Credit brokers are specialists with the necessary information and professional contacts with credit institutions. They provide individual assistance to clients in selecting optimal lending options. They also assist with obtaining the needed financing, its conversion, and repayment, etc. Operations on the exchange market are difficult for outsiders and require a certain number of special approvals and permissions to finalize transactions.

GoodRx, Health Data Brokerage, and the Limits of HIPAA – Lawfare

GoodRx, Health Data Brokerage, and the Limits of HIPAA.

Posted: Mon, 06 Mar 2023 08:00:00 GMT [source]

The larger brokerage firms tend to carry an inventory of shares available to their customers for sale. They do this to help reduce costs from exchange fees, but also because it allows them to offer rapid access to popularly held stocks. This means that unlike many larger brokers they carry no inventory of shares, but act as agents for their clients to get the best trade executions. Most discount brokerages now offer their customers zero-commission stock trading. Where insurance is concerned, a broker is also the term for one who sells insurance. Like the brokers at a brokerage firm, these insurance professionals earn a commission from every insurance policy they sell.

Captive Brokerage

Another example would be a discount broker, where advisory services are not included. Let’s imagine that Michael has signed up with an online share-dealing platform and deposited his first payment into the account. When he’s decided on investment strategy, Michael makes a market order on a platform, which his online broker executes. Traditionally, brokers communicated with clients via a phone or face to face, and offered personalised investment strategies and advice. They charged high commissions and were exclusive to high net-worth individuals. A real estate broker searches for buyers and sellers of real estate, e.g., warehouses, offices, retail, as well as residential properties.

In addition, many financial services companies also have brokerage houses as part of their broader services. Full-service brokers offer a variety of services, including market research, investment advice, and retirement planning, on top of a full range of investment products. For that, investors can expect to pay higher commissions for their trades. Brokers receive compensation from the brokerage firm based on their trading volume as well as for the sale of investment products. An increasing number of brokers offer fee-based investment products, such as managed investment accounts. Discount brokers can execute many types of trades on behalf of a client, for which they charge a reduced commission in the range of $5 to $15 per trade.

They don’t offer investment advice and brokers usually receive a salary rather than a commission. Most discount brokers offer an online trading platform which attracts a growing number of self-directed investors. An online brokerage firm is a brokerage firm that provides its services through the internet. There is the type that doesn’t have any physical offices at all. And then there are those that operate under a full-service or discount firm.

Today though, many of these discount brokerage firms also provide access to online research services you can read through yourself to make your decisions. The commissions charged by discount brokerage firms are cheaper than those of full-service brokerage firms. Like a full-service brokerage firm, you can make trade over the phone or online. A brokerage firm buys and sells stocks, bonds, options and other financial products on behalf of clients. Many brokerages hire individual brokers as a way to pool resources and offer the best service.

While they can present insurance policies for an insurer, they don’t have the legal right to act on the company’s behalf. For example, a broker would not have the authority to issue a policy or determine a policy’s premiums. Online brokers, unlike face-to-face ones, do not provide personalized advice.

Captive agents represent only one insurance company, which means many of them have a deep knowledge of the products and services that the company offers. Captive agents might also have relationships with underwriters and corporate employees since they work with the same insurance company. The online broker’s automated network is the middleman, handling buy and sell orders that are input directly by the investor.

You may need a broker if you want to trade on financial markets. Brokers are professionals who buy and sell financial instruments on behalf of their clients. The necessity for prime brokerage arose from the growth in hedge funds.

They can also provide advice on what to buy and sell, and help with financial planning. A brokerage firm primarily makes money through commission fees. Brokerage houses have the right to charge these fees for the financial services they provide. Brokers provide that service and are compensated in various ways, either through commissions, fees, or through being paid by the exchange itself. Investopedia regularly reviews all of the top brokers and maintains a list of the best online brokers and trading platforms to help investors make the decision of what broker is best for them.

- This may get you noticed but in order to actually be hired and perform as a broker, you will need to be appropriately licensed.

- Fierce competition on the web and, later, on phone apps, have led most competitors to drop their fees to zero for basic stock trading services.

- With others, you may have no communication at all with an investment professional.

- As an investor, the choice between a full-service or discount broker is an important one.

- Ariel Courage is an experienced editor, researcher, and former fact-checker.

- We believe everyone should be able to make financial decisions with confidence.

There are three types of brokerage firms that we looked at in this lesson. Examples of a full-service broker might include offerings from a company such as Morgan Stanley, Goldman Sachs, or even Bank of America Merrill Lynch. Some full-service brokerages offer a lower-cost discount brokerage option as well. Intellectual property brokers mediate between buyers and sellers of intellectual property. They may also manage the many steps in the intellectual property process.

Robo-advisors have their appeal, not the least of which is very low entry fees and account balance requirements. Most charge no annual fee, zero commissions, and set their account requirements to a few dollars. A robo-advisor is an online investment platform that uses algorithms to implement trading strategies brokerage company definition on behalf of its clients in an automated process. According to a study by the United States Government Accountability Office, insurance brokers and agents must obtain a state license and comply with insurance regulations. To qualify for a license, a broker must meet rigorous qualifications.

Different types of brokerages are available, so you should carefully consider which type best fits your needs. Registered investment advisors (RIAs) are the most common type of independent broker found today. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader.

FMCSA guidance on when dispatch services need broker authority – Overdrive

FMCSA guidance on when dispatch services need broker authority.

Posted: Tue, 15 Nov 2022 08:00:00 GMT [source]

A discount broker is a stockbroker who performs buy and sell orders at a reduced commission rate. Finding the right brokerage firm can be an important piece of any successful financial plan. Read on to learn about what a brokerage firm is, what it can do for you, and what you should look for when selecting a broker. Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed here. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear).

NACFB stands for the National Association of Commercial Finance Brokers. Meanwhile, prime brokerage services are those brokers who work with institutions such as hedge funds. Brokers also sell trades to market makers, which earns them a small fee per trade. Investors rarely notice this, but it can in some cases slow trade execution and increase the cost of the trade slightly.

What is the role of brokers company?

The vital role of a brokerage company is to act as an intermediary, connecting buyers and sellers to allow for a transaction. Brokerage firms can receive payment through a commission (either a flat fee or a percentage of the transaction amount) once the transaction is completed successfully.

The value of shares and ETFs bought through a share dealing account can fall as well as rise, which could mean getting back less than you originally put in. Broker regulation varies from country to country, so it’s important to conduct your own due diligence and look into your local broker licenses. Add brokerage to one of your lists below, or create a new one. Get advice on achieving your financial goals and stay up to date on the day’s top financial stories.

They not only execute trades for you, but also provide a range of other services, which might include tax planning, research, investment advice, and estate and retirement planning. A full-service brokerage will typically have a dedicated broker who can meet with you in person and provide personalized advice based on your specific circumstances. The next step is to fund the account using a bank transfer, check or transfer of assets from another brokerage firm. After that, you can choose the type of investment, such as stocks, bonds, mutual funds and exchange-traded funds. The online broker who offers free stock trades receives fees for other services, plus fees from the exchanges. In the past, only wealthy people used a broker for stock market trading.

What is an example of a brokerage firm?

They are often referred to as the ‘big four brokerages.’ Each of these firms—Charles Schwab, Fidelity Investments, E*TRADE, and TD Ameritrade—comprise the top in terms of customers and assets. This short article analyzes the products, services, and fee structure of each brokerage.